workers comp taxes texas

No workers comp isnt taxable. It is estimated that employers in the state of Texas will pay a premium of 052 per 100 in insured payroll for workers compensation insurance.

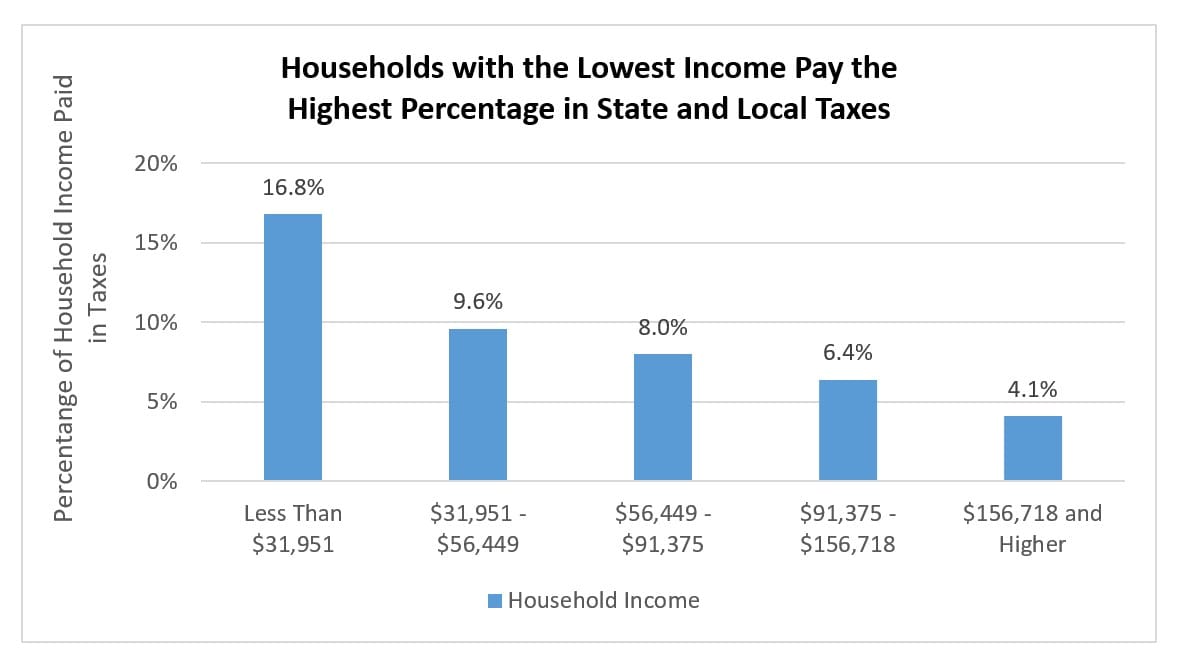

Who Pays Texas Taxes Every Texan

Coverages for Workers Comp Insurance in Texas Income benefits such as lost wages from missing work.

. Your effective tax rate multiplied by your taxable wages determines the amount of tax you pay. Failing to report required income on your federal tax. The University of North.

Medical benefits to help treat a work-related injury or illness. This typically means they cannot receive workers compensation. These workers are classified as exempt through a 1099 form and pay for their own income tax.

Employer costs for unemployment insurance and workers compensation are relatively low in Texas. As you can see there are limits to workers comp. If you received benefits from workers compensation you know that it is designed to reimburse you for expenses from work-related.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from. Generally speaking you will not be taxed on payments that you receive from workers compensation in your state. If you are receiving workers compensation benefits and have questions or concerns about which portion if any is taxable.

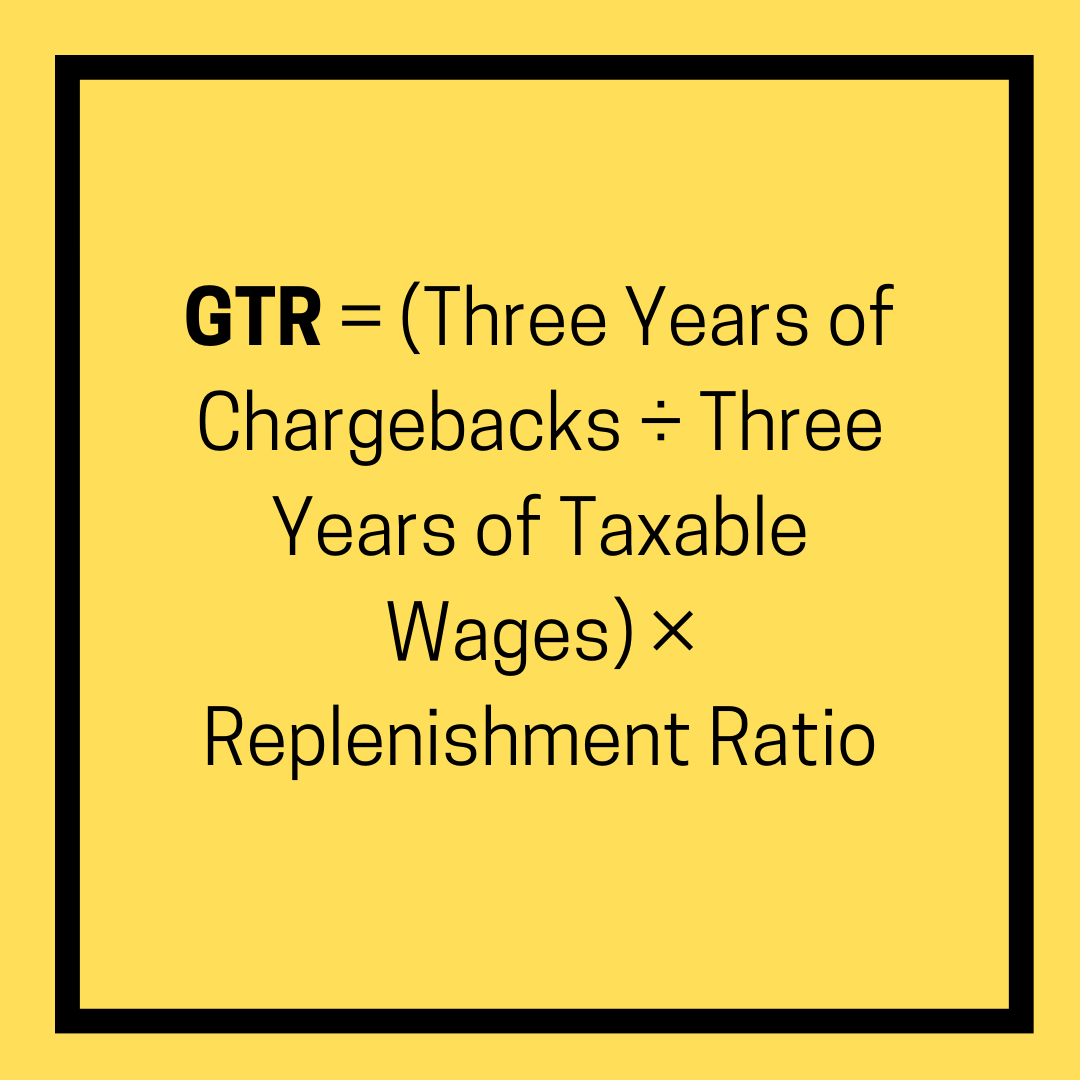

Additional Medicare tax needs to be paid depending on the filing. Your taxable wages are the sum of the wages you pay up to 9000 per employee per year. Understanding workers compensation in Texas.

Consulting a workers compensation attorney like Thompson Law about your specific situation is something you will not want to delay. Limitations of Workers Comp Benefits. In General Workers Comp Settlements Are Not Taxable.

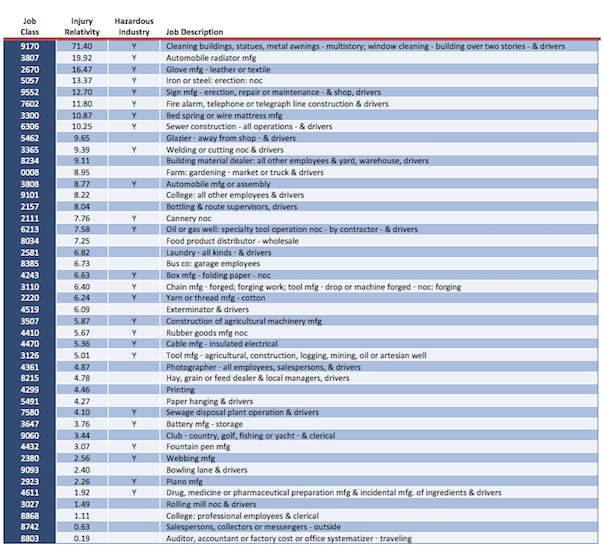

Vary each year as adopted by the Texas Department of Insurance. Texas Workers Compensation Act in PDF format. Refer to 28 TAC Rule 1414 and our publication Insurance Maintenance Tax Rates and Assessments on Premiums.

I just need to know a few things about WC and taxes. 12072022 Dan Jones. Do we pay income taxes on WC in the state of texas my company and ins company both are registered in tennesse.

For the most part you will not have to list workers compensation settlement money as income when filing your. Texas unlike other states does not require an employer to have workers compensation coverage. Call an Experienced Workers Compensation Attorney Today.

Unemployment Insurance Workers Compensation. Subscribing to workers compensation insurance puts a limit. Do you claim workers comp on taxes the answer is no.

Up to 25 cash back Workers comp will also pay up to 10000 for burial expenses. The Medicare tax rate is 145 of all earnings of both employees and employers.

/https://static.texastribune.org/media/files/2c80fe77f6e2a3c06be6bd8c4a7baeeb/06%20Glenn%20Hegar%20Biennial%20Revenue%20Estimate%20MG%20TT.jpg)

Texas Property Tax Cuts School Funding Raise Sustainability Questions The Texas Tribune

2020 Guide To Texas Workers Compensation Stats Foresight

Bad Workers Comp Lawyers Is It Time To Fire Your Attorney

Workers Compensation In Texas Bexar County Tx Official Website

A Complete Guide To Texas Payroll Taxes

Texas Nanny Tax Rules Poppins Payroll Poppins Payroll

Texas Workers Compensation Laws Costs Providers

New Tax Laws Benefit Texas Workers In Alternative Plans Partnersource

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

The Complete Guide To Texas Payroll Taxes 2022

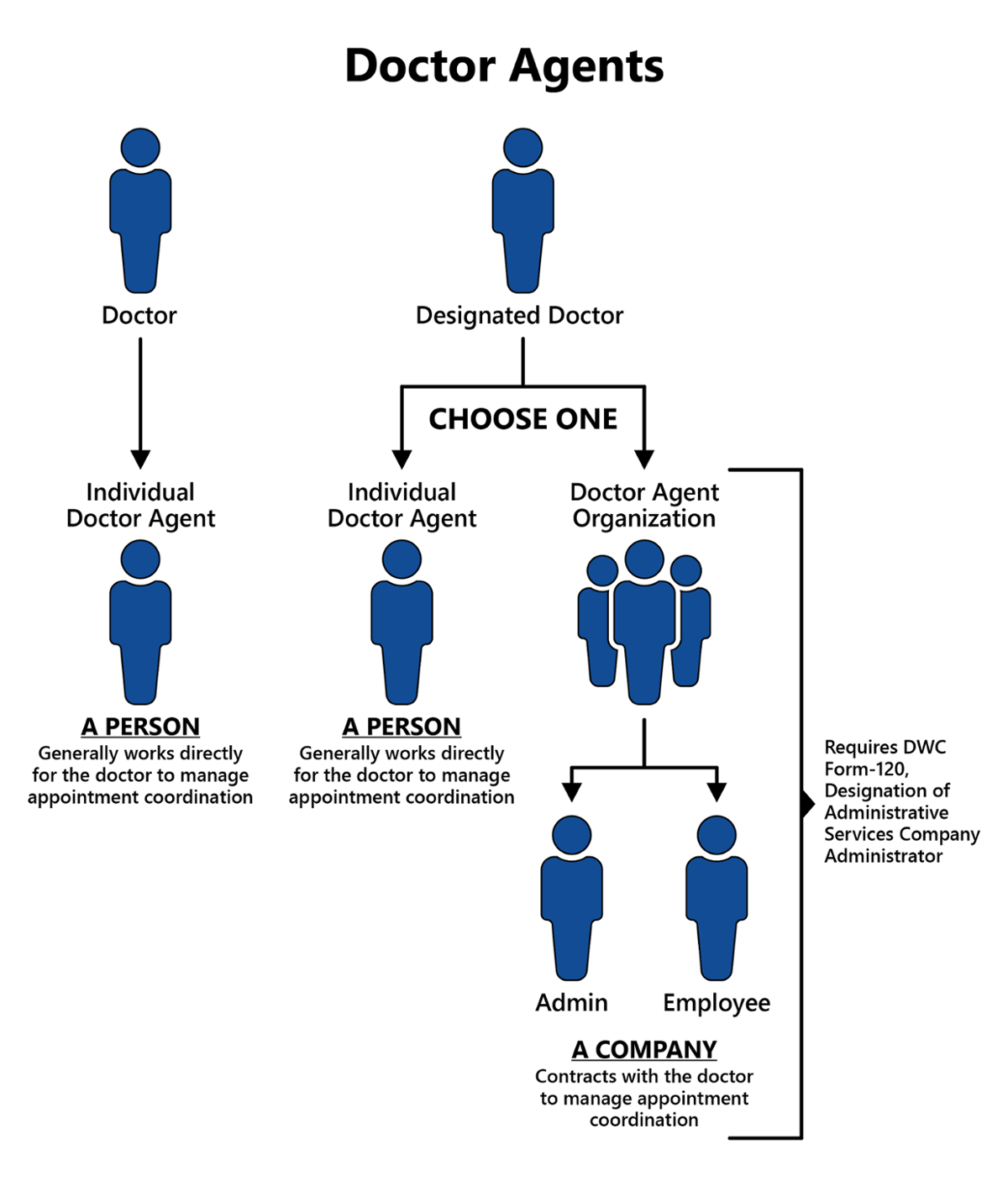

Txcomp Claims And Coverage Systems

A Complete Guide To Texas Payroll Taxes

Plaintiff S Second Amended Petition September 02 2014 Trellis

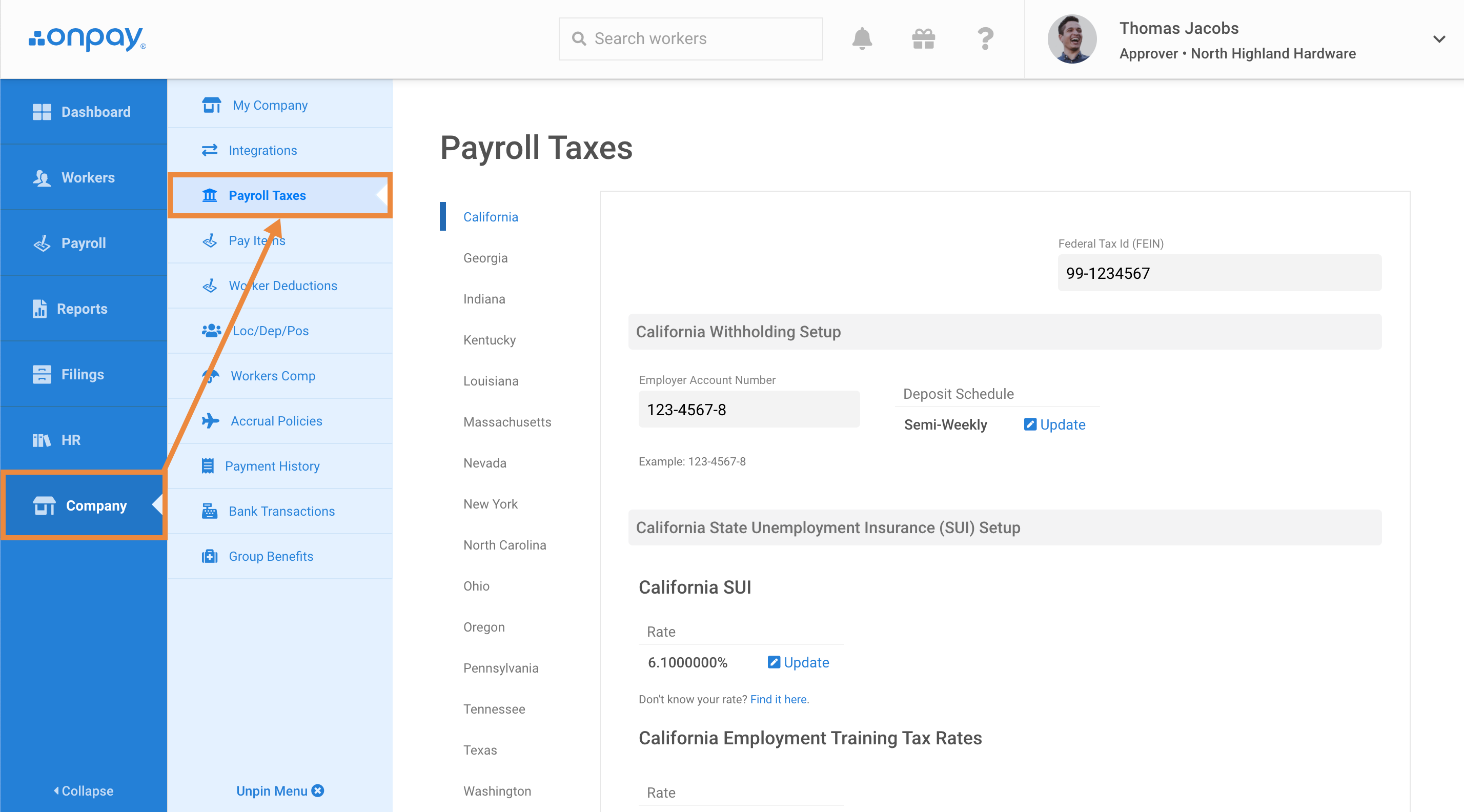

Add Or Update State Payroll Tax Information Help Center Home

Texas Sales Tax Holiday Is Aug 5 7 News Palestineherald Com

Workers Compensation Laws By State Embroker

Dwc Form 83 Fill Online Printable Fillable Blank Pdffiller

Workers Compensation Deadlines All 50 States Workinjurysource Com